With our newly improved suite of personal credit cards, it's easy to find the most rewarding match for your spending style. Whether you love to travel, earn unlimited cash back or simply build credit, we've got the card for you.

Best for Cash Back

Seamlessly transform everyday purchases into unlimited cash back with this personal credit card.

Best for Everyday Purchases

Earn more rewards points on everyday purchases like gas and groceries.

Best for Building Credit

This personal credit card can help you earn unlimited cash back while you build your credit.

Best for Low Interest

Get our lowest available rate and transfer balances to consolidate your debt.

Best for Traveling

Earn more points on travel and get exclusive travel rewards, including an ancillary $100 annual travel credit. D

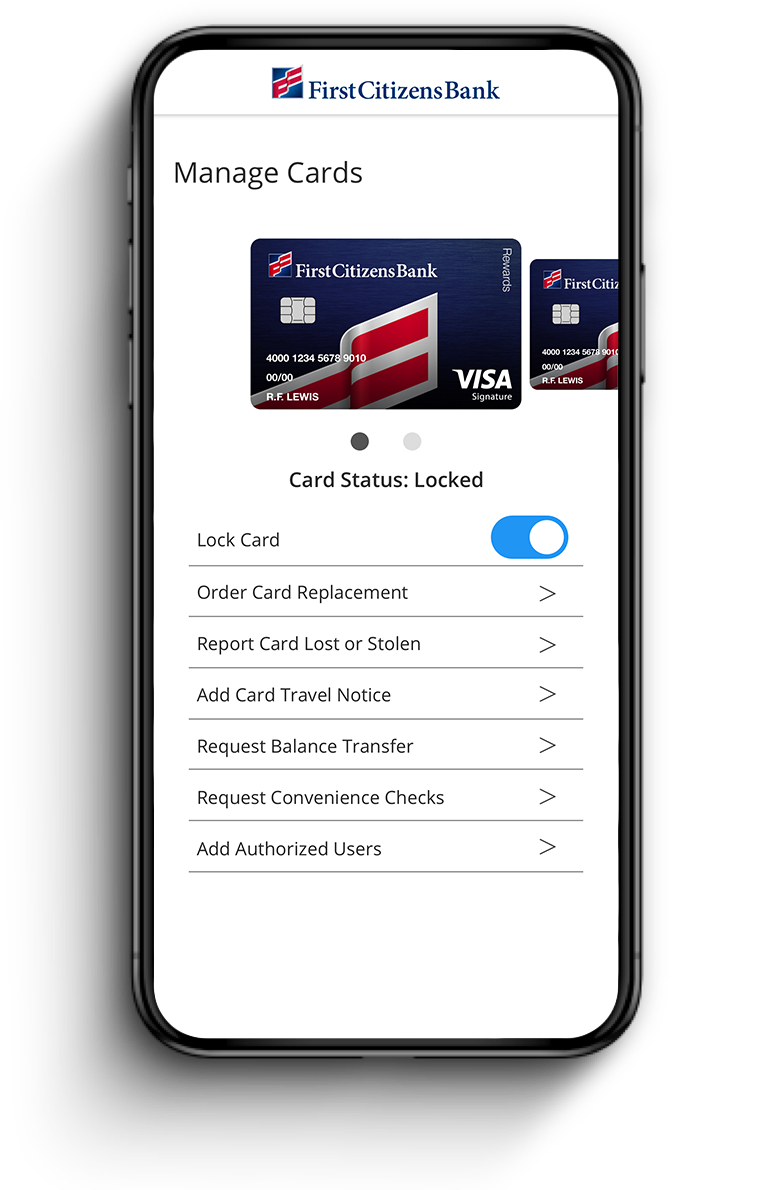

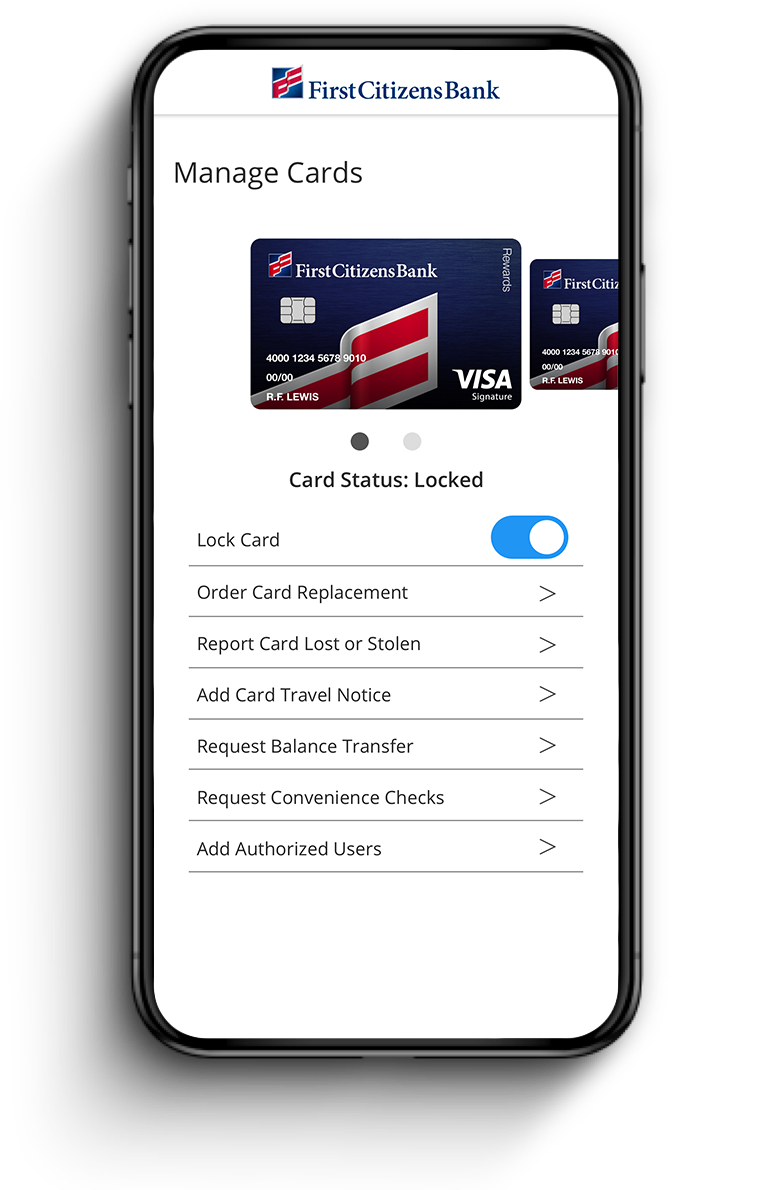

Temporarily lock your card

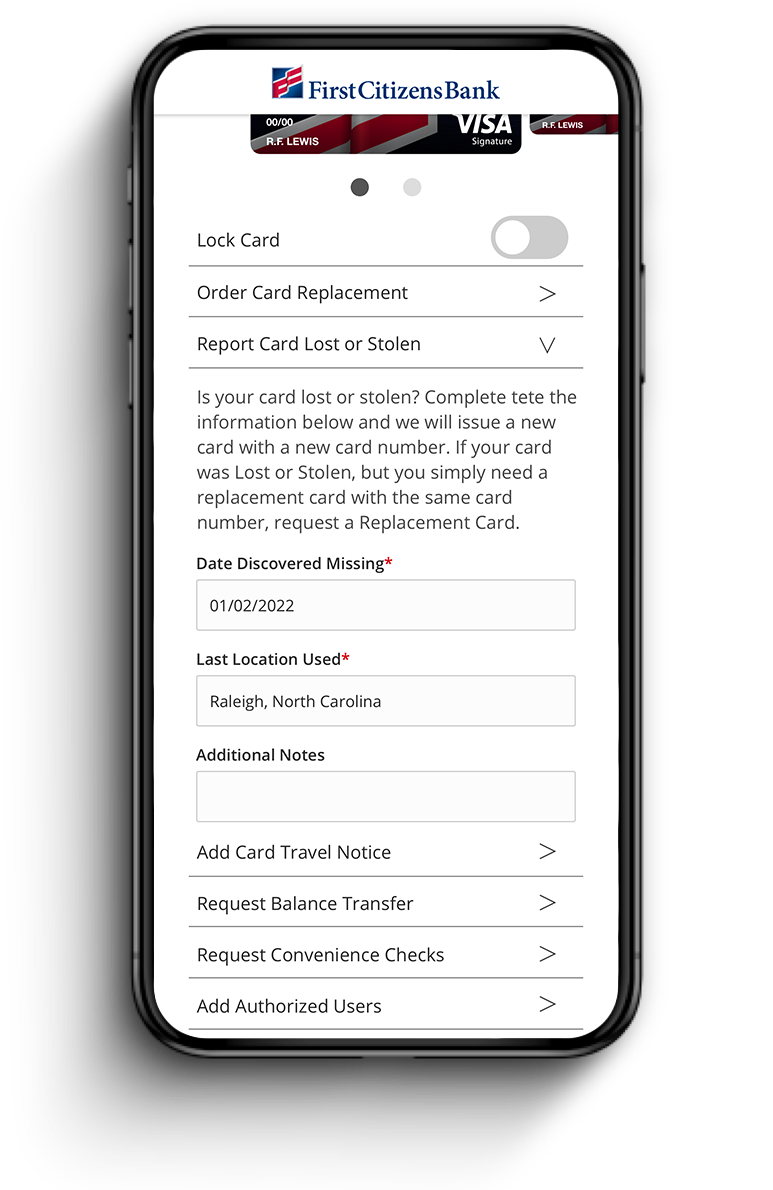

Report a lost or stolen card

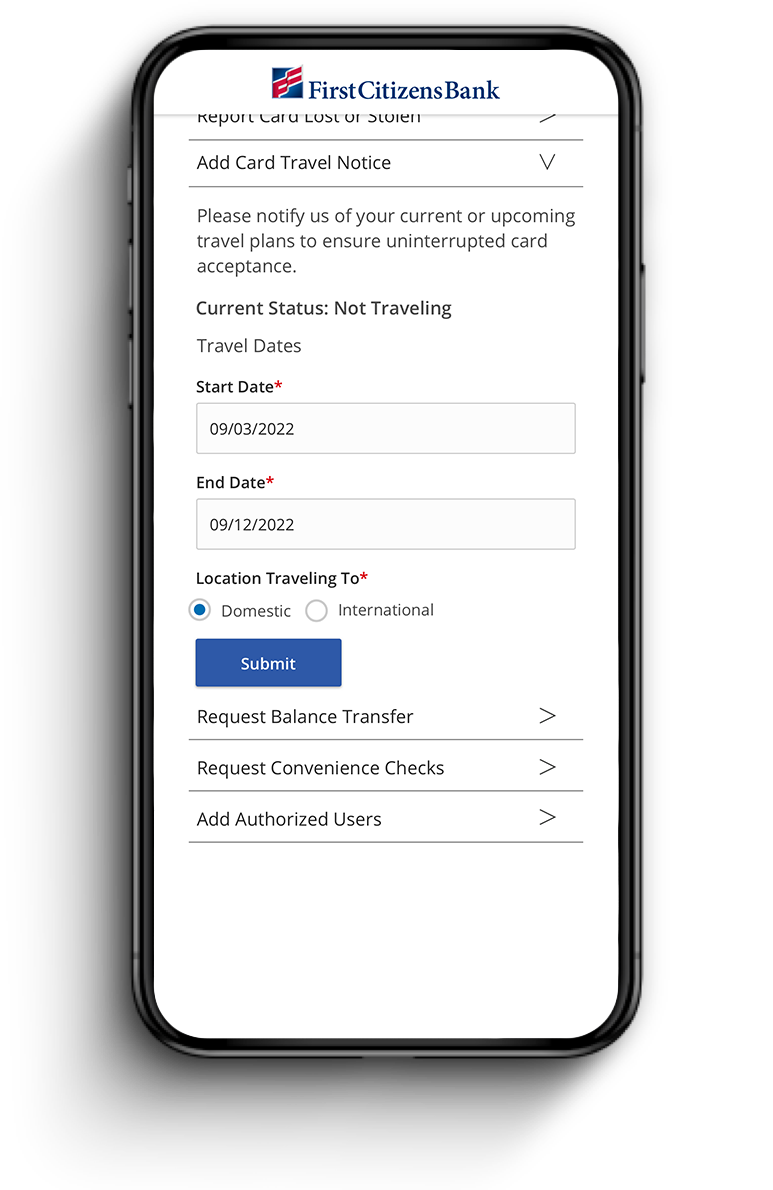

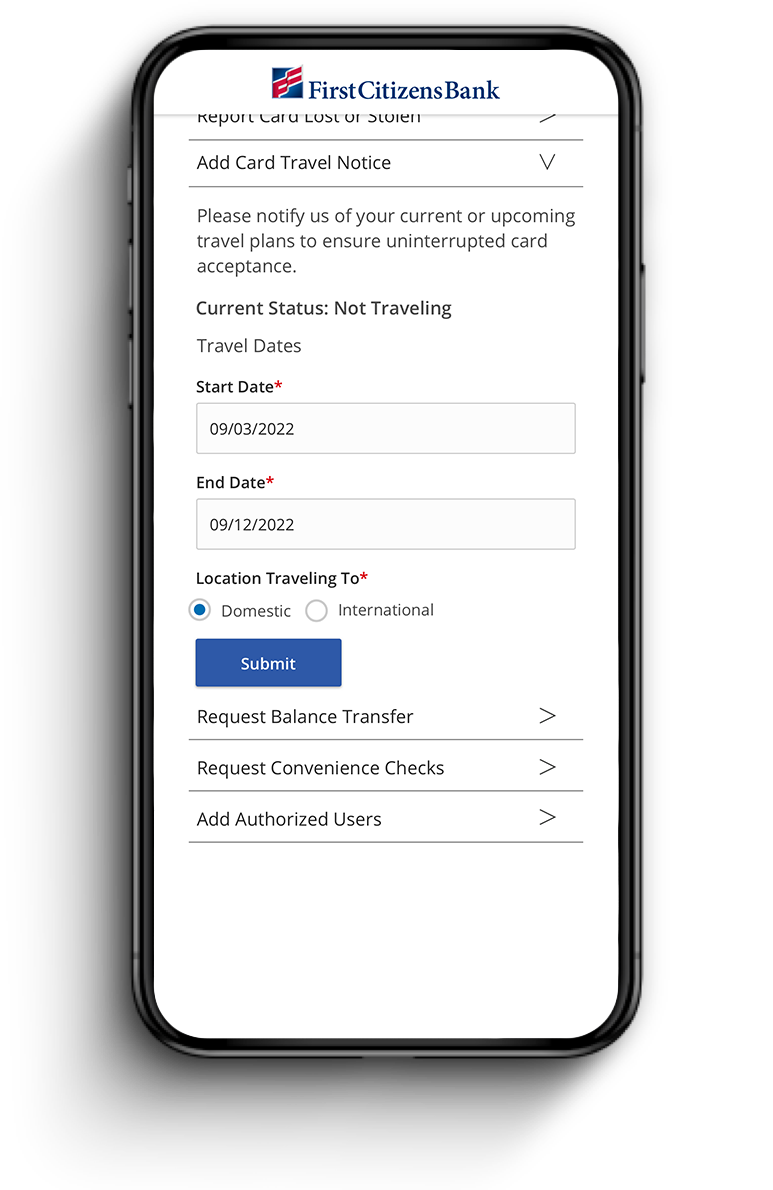

Notify us if you're traveling

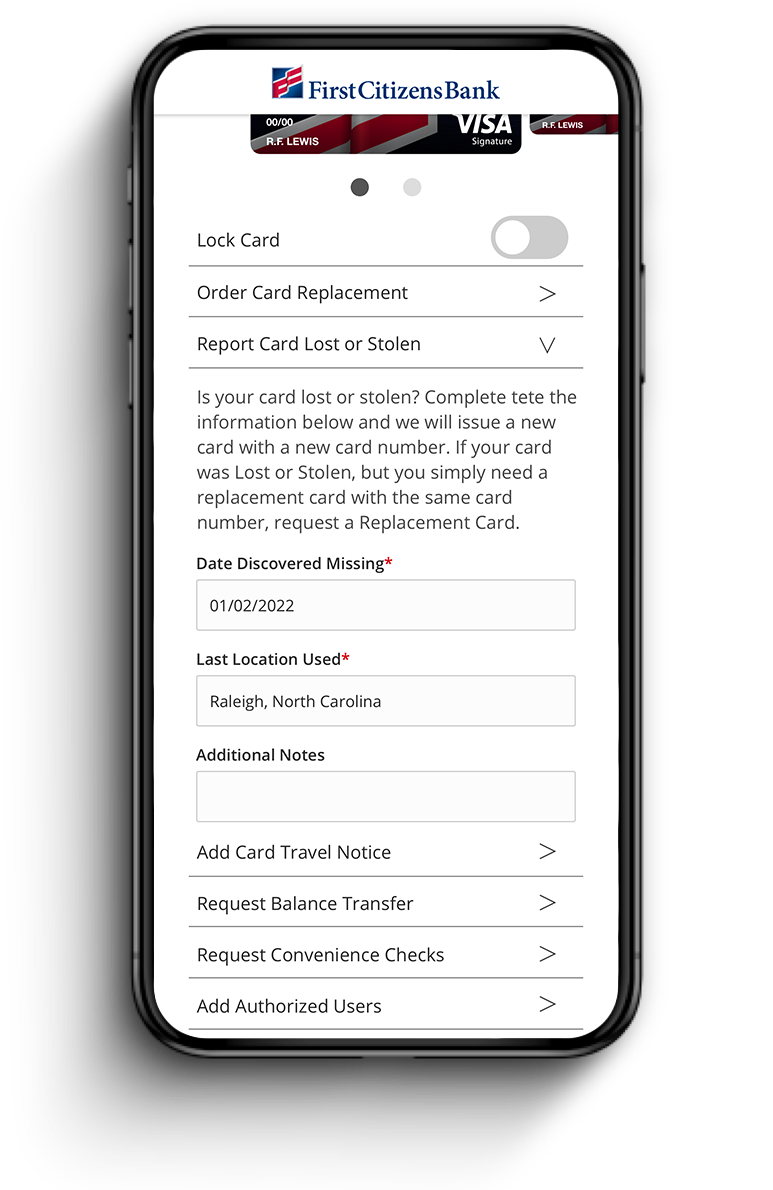

Temporarily lock your card

Report a lost or stolen card

Notify us if you're traveling

First Citizens Rewards® consumer cardholders who have a credit line of $5,000 or more, are automatically upgraded to Visa® Signature status and have access to enhanced benefits.

What's an APR?An APR, or annual percentage rate, represents the cost of credit on a yearly basis.

Can I access my credit card information online?Yes. You can access your First Citizens credit card information online through Digital Banking. You can view your current account status and review 6 months' worth of transaction history. You can also access account information and view recent transactions in Mobile Banking.

Customers with Digital Banking access can switch to email delivery and go paperless for all credit card statements. To enroll, log in to Digital Banking.

How do I dispute a charge that appears on my credit card?If you see a suspicious charge, call 800-543-9000 then select the Report Fraud option. For your awareness, pending transactions do not have an impact on your current account balance because they have not been processed yet. Please continue to monitor your account and notify us immediately for any unauthorized posted transactions.

How can I make payments on my credit card?It's easy. We provide several convenient payment options:

Change your passwords often, and use a password manager if you tend to forget password, or don't know how to create strong options.

When looking for a lower interest rate on a loan, shop around and consider all options before deciding.

Not all loans are created equal.

Comparing rewards programs can help you find the right credit card for your goals and spending style.

The most common rewards cards offer one of three types of benefits: cash back, travel miles or rewards points.

DisclosuresNormal credit approval applies.

APR (annual percentage rate). The Prime Rate used to determine your APR is the Prime Rate as published in The Wall Street Journal on the last business day of the preceding calendar month. The current Prime Rate as of July 31, 2023, is 8.50% and may vary in the future. The transaction fee for cash advances is $10 or 5% of the amount of the cash advance, whichever is greater. The transaction fee for foreign transactions is 3% (0% for Travel Rewards) of each transaction after conversion to US dollars.

Purchases are defined as gross retail purchases less any returns or credits.

Balance transfer must occur within the first 90 days of account opening to qualify for the 0% APR (annual percentage rate) introductory offer and will be subject to a balance transfer fee of $5 or 3% of the amount of each transfer, whichever is greater. After the 12 billing cycle period, your APR will default to your purchase APR .

Cash back rewards can be redeemed as a statement credit or as a deposit into your First Citizens checking or savings account.

FICO® and “the score lenders use” are registered trademarks of Fair Isaac Corporation in the United States and other countries.

FICO® Score and associated educational content are provided solely for your own non-commercial personal review, use and benefit. First Citizens Bank and Fair Isaac are not credit repair organizations as defined under federal or state law, including the Credit Repair Organizations Act. First Citizens Bank and Fair Isaac do not provide "credit repair" services or advice or assistance regarding "rebuilding" or "improving" your credit record, credit history or credit rating.

Certain terms, conditions, and exclusions apply. For complete details, refer to the Travel Rewards Program Terms.

Merchants who accept Visa credit cards are assigned a merchant code, which is determined by the merchant or its processor in accordance with Visa procedures based on the kinds of products and services they primarily sell. We group similar merchant codes into categories for purposes of making reward offers to you. We make every effort to include all relevant merchant codes in our rewards categories. However, even though a merchant or some of the items that it sells may appear to fit within a rewards category, the merchant may not have a merchant code in that category. When this occurs, purchases with that merchant won't qualify for rewards offers on purchases in that category.

The $95 initial Annual Fee will be waived the first year but charged to your Travel Rewards Credit Card Account every 12 months thereafter.

APR (annual percentage rate). The Prime Rate used to determine your APR is the Prime Rate as published in The Wall Street Journal on the last business day of the preceding calendar month. The current Prime Rate as of July 31, 2023, is 8.50% and may vary in the future. The transaction fee for foreign transactions is 3% of each transaction after conversion to US dollars.

Links to third-party websites may have a privacy policy different from First Citizens Bank and may provide less security than this website. First Citizens Bank and its affiliates are not responsible for the products, services and content on any third-party website.

Bank deposit products are offered by First Citizens Bank. Member FDIC and an Equal Housing Lender. icon: sys-ehl.